BUILDING LANDMARKS, CHARTING GROWTH

135

Annual Report 2015

The aggregate remuneration paid to the top six key

management personnel of the Company (excluding the

CEO) for the Period was S$3,088,528.27.

In the Period, there were no termination, retirement or

post-employment benefits granted to Directors, the

CEO and key management personnel. There were also

no special retirement plan, ‘golden parachute’ or

special severance packages given to the key

management personnel.

Guideline 9.4: Remuneration of related employees

The Company does not have any employee who is an

immediate family member of a Director or the CEO for

the Period. “Immediate family member” refers to the

spouse, child, adopted child, step-child, sibling or parent.

Guideline 9.5: Employee shares scheme

Details on the Perennial Employee Share Option

Scheme 2014 can be found in the Directors’

Statement from pages 180 to 182 and in the Notes to

Financial Statements from pages 228 to 230.

Guideline9.6: Disclosureon linkbetweenperformance

and remuneration

The RC ensures that the remuneration structure is

strongly linked to the achievement of corporate and

individual performance targets while maintaining high

flexibility and responsiveness to the market conditions

and Perennial’s performance. The performance targets

as determined by the RC each year are set at realistic

yet enhanced levels to motivate a high degree of

performance with emphasis on both short and

long-term objectives.

In relation to the key management personnel, the

Company noted that the Code recommends that at least

the top five key management personnel's remuneration

be disclosed. After careful consideration, the Board

believes that such disclosure would be disadvantageous

to Perennial's business interests, taking into

consideration the competitive pressures in the talent

market. The Company believes that in view of the

competitive human resource environment and to support

the Company's effort in attracting and retaining executive

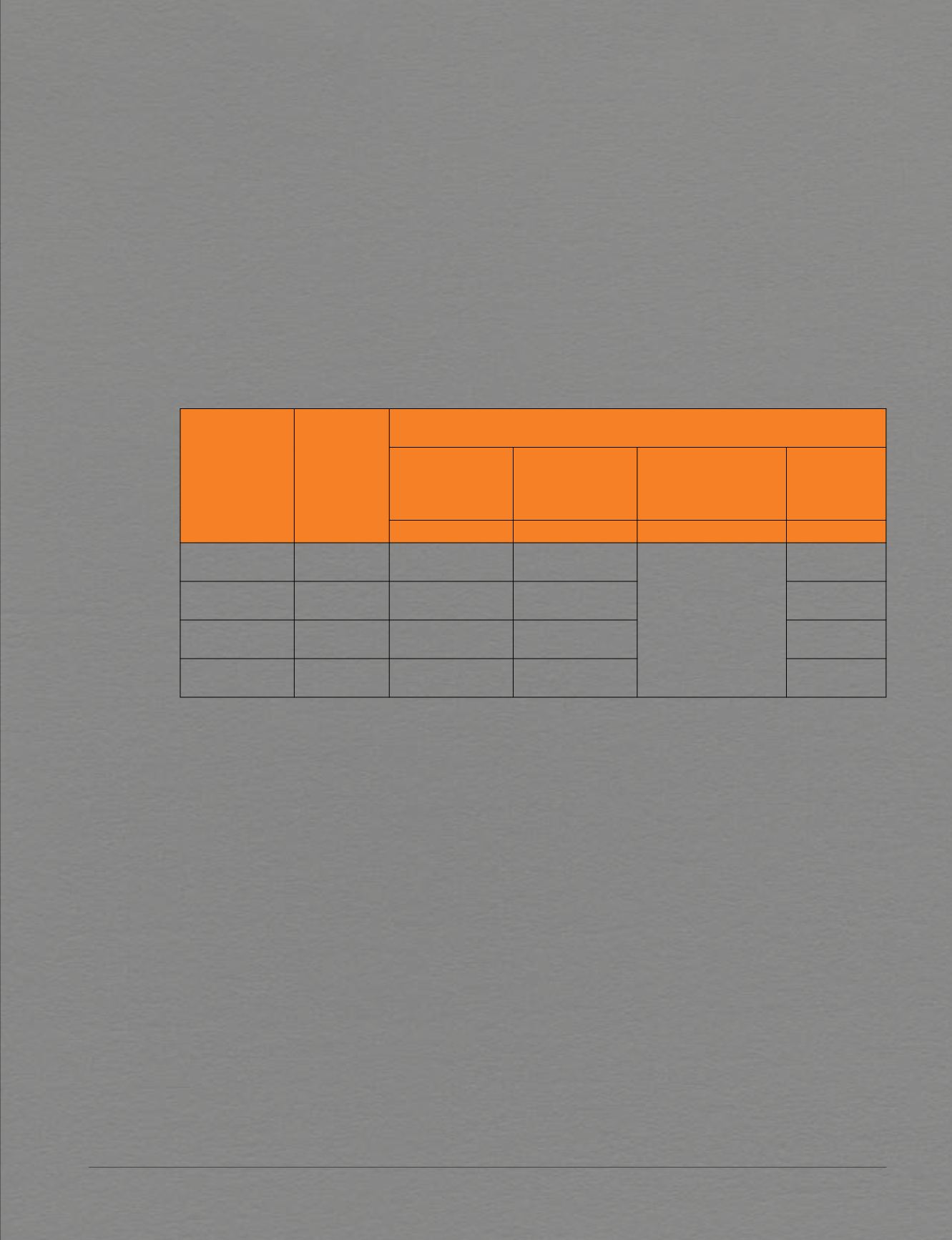

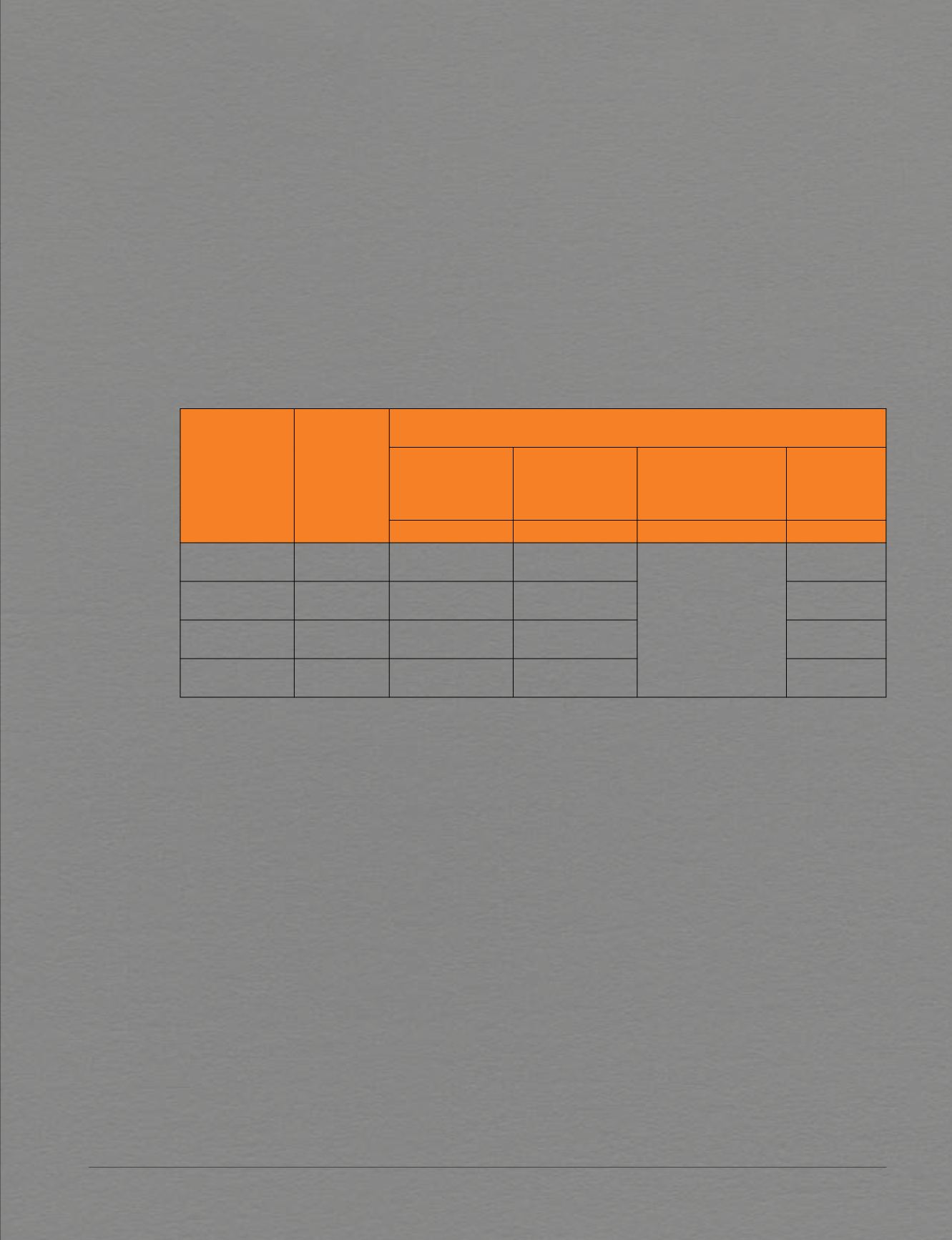

Note 1:

The above remuneration bands exclude the grant of share options to staff under the Perennial Employee Share Option Scheme 2014. The Share Plan was

approved by the Shareholders at an Extraordinary General Meeting held in October 2014 and is administered by the RC.

Share Options were granted during the year, to be vested from FY2016 onwards. Fair value of vested shares will be declared on their vesting in the

remuneration disclosure for FY2016, where applicable

talents, it should maintain confidentiality on employee

remuneration matters.

For these reasons, the Company is only disclosing the

remuneration in percentage terms in bands of

S$100,000 for the Period. The Board is of the opinion

that the information disclosed would be sufficient for

the Shareholders to have an adequate appreciation of

the Company's compensation policies and practices.

For the period from 28 October 2014 to 31 December 2015

Remuneration

Bands

No. of

Executives

Salary inclusive

of AWS and

employer's

CPF

Bonus and other

benefits inclusive

of employer's

CPF

Stock options

granted and other

share-based

incentives and awards

Total

%

%

%

%

S$700,000 -

S$799,000

1

62.3

37.7

Please see Note 1

100

S$500,000 -

S$599,000

2

73.3

26.7

100

S$400,000 -

S$499,000

2

77.6

22.4

100

S$300,000 -

S$399,000

1

97.5

2.5

100