222

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

NOTES TO THE FINANCIAL STATEMENTS

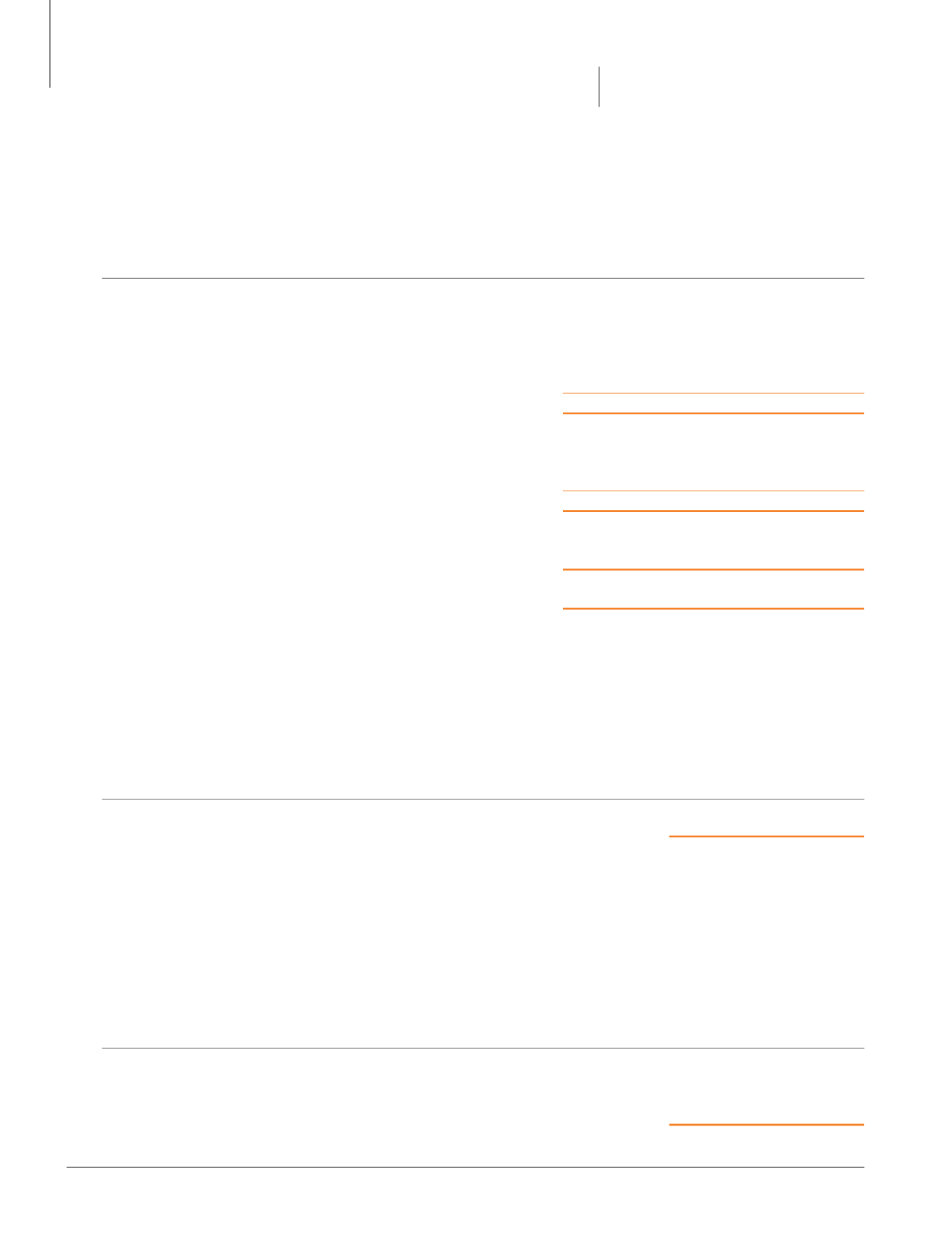

7 INTANGIBLE ASSETS AND GOODWILL

Management

Goodwill

contracts

Total

$’000

$’000

$’000

Group

Cost

At 1 July 2013, 30 June 2014 and 1 July 2014

–

–

–

Acquisitions (note 4)

63,155

28,244

91,399

At 31 December 2015

63,155

28,244

91,399

Accumulated amortisation

At 1 July 2013, 30 June 2014 and 1 July 2014

–

–

–

Amortisation charge for the period

–

(3,295)

(3,295)

At 31 December 2015

–

(3,295)

(3,295)

Carrying amounts

At 30 June 2014

–

–

–

At 31 December 2015

63,155

24,949

88,104

Amortisation

The amortisation of management contracts is included in administrative expenses.

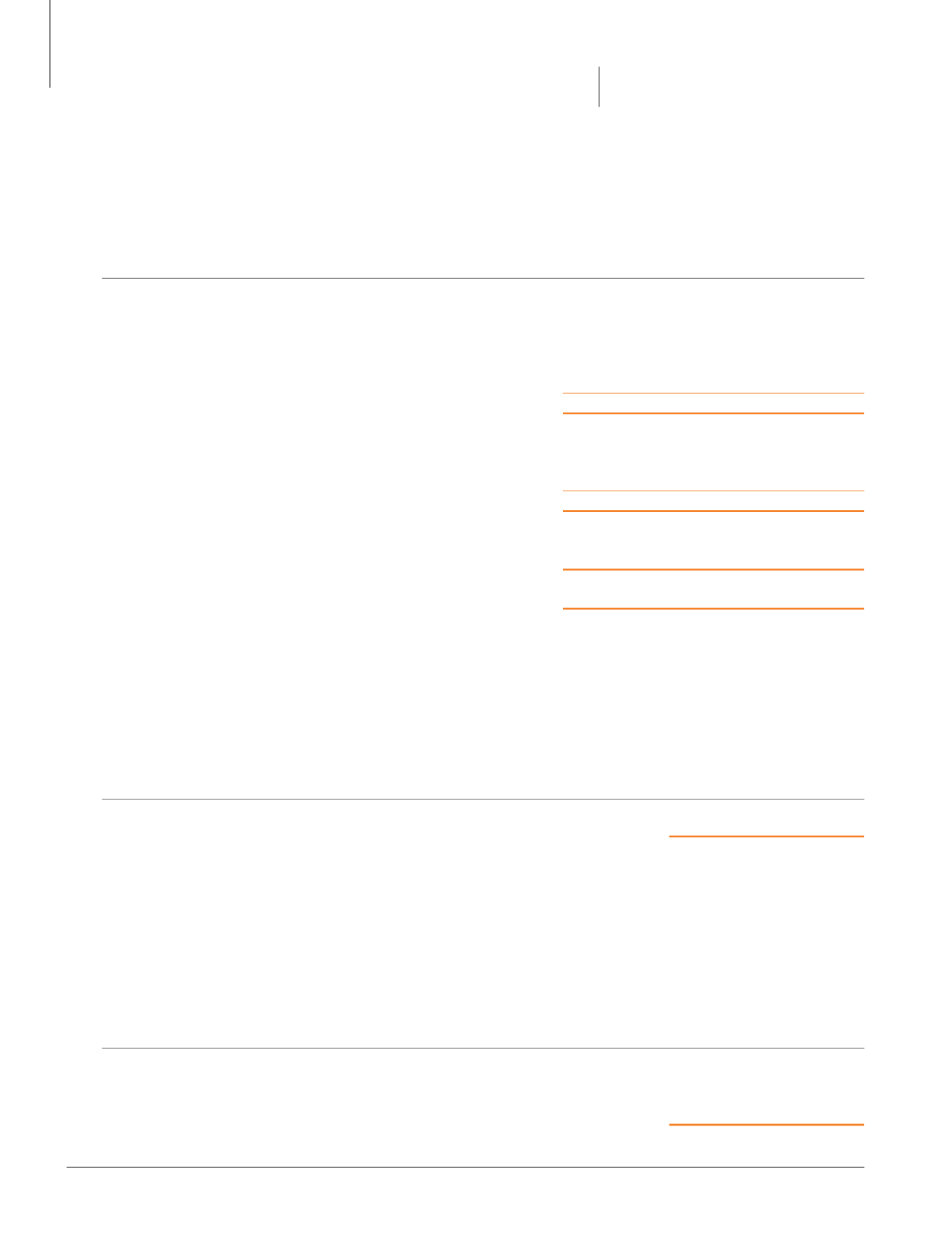

Impairment testing for CGUs containing goodwill

For the purposes of impairment testing, goodwill has been allocated to the Group’s CGU as follows:

31/12/2015

30/6/2014

$’000

$’000

Management business

63,155

–

The recoverable amount of this CGU was determined based on value-in-use, estimated using discounted cash flows.

The fair value measurement was categorised as a Level 3 fair value based on the inputs in the valuation technique used

(see note 2.4).

The key assumptions used in the estimation of the recoverable amount are set out below. The values assigned to the key

assumptions represent management’s assessment of future trends in the relevant industries and have been based on

historical data from both external and internal sources.

31/12/2015

30/6/2014

%

%

Discount rate

9.6 – 11.4

–

Terminal value growth rate

3.0 – 5.0

–

Budgeted EBITDA growth rate

3.0 – 5.0

–