232

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

NOTES TO THE FINANCIAL STATEMENTS

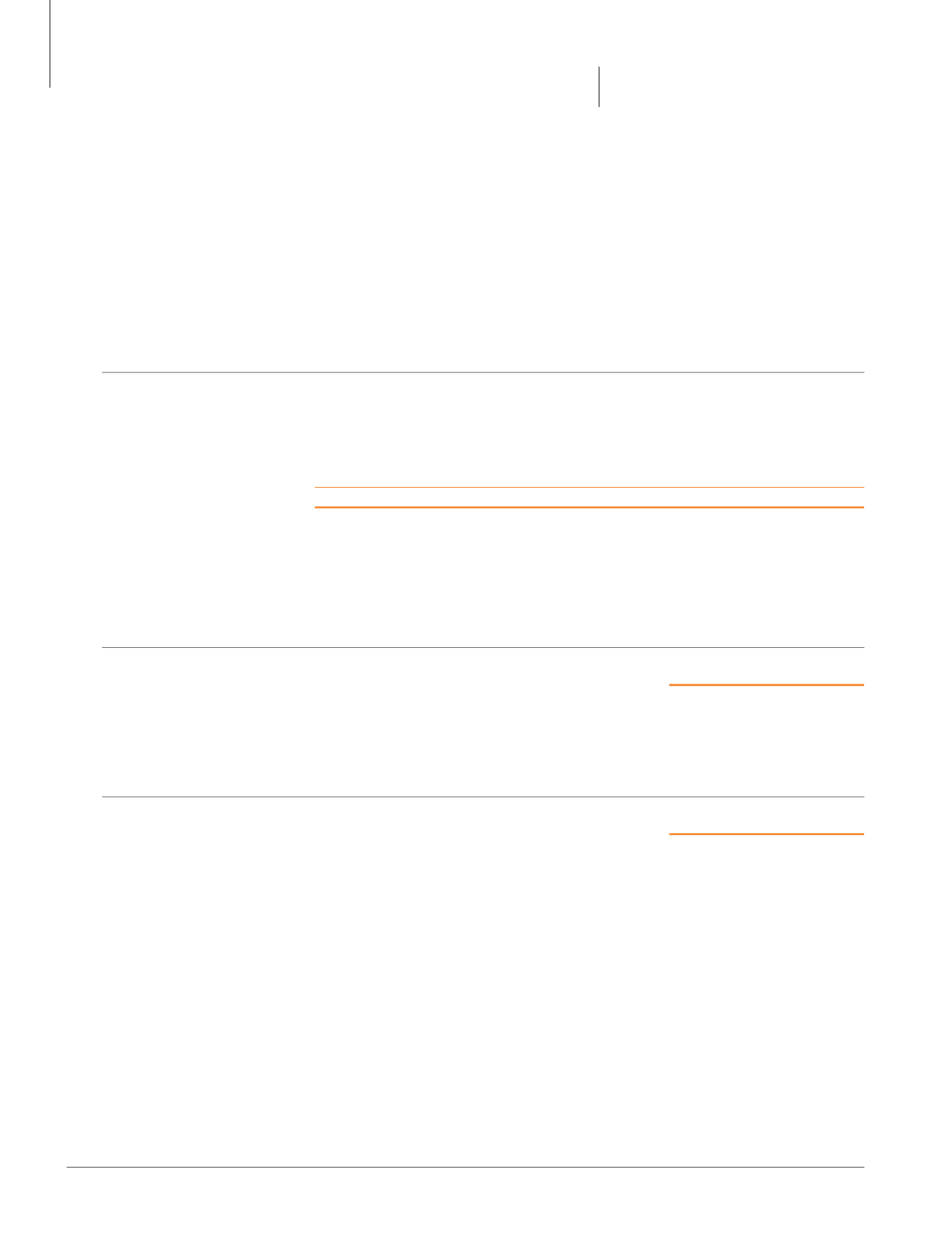

17 DEFERRED TAX LIABILITIES

Recognised deferred tax liabilities

Movements in temporary differences during the year are as follows:

Acquisition Recognised

Balance Recognised Balance

during in profit

Balance

as at

in profit

as at the period

or loss Exchange

as at

1/7/2013

or loss 30/6/2014 (note 4)

(note 25) differences 31/12/2015

$’000

$’000

$’000

$’000

$’000

$’000

$’000

Group

Investment properties

–

–

–

42,358 13,402

1,695 57,455

Undistributed profits of

joint venture

11

(11)

–

1,269

669

1

1,939

11

(11)

–

43,627 14,071

1,696 59,394

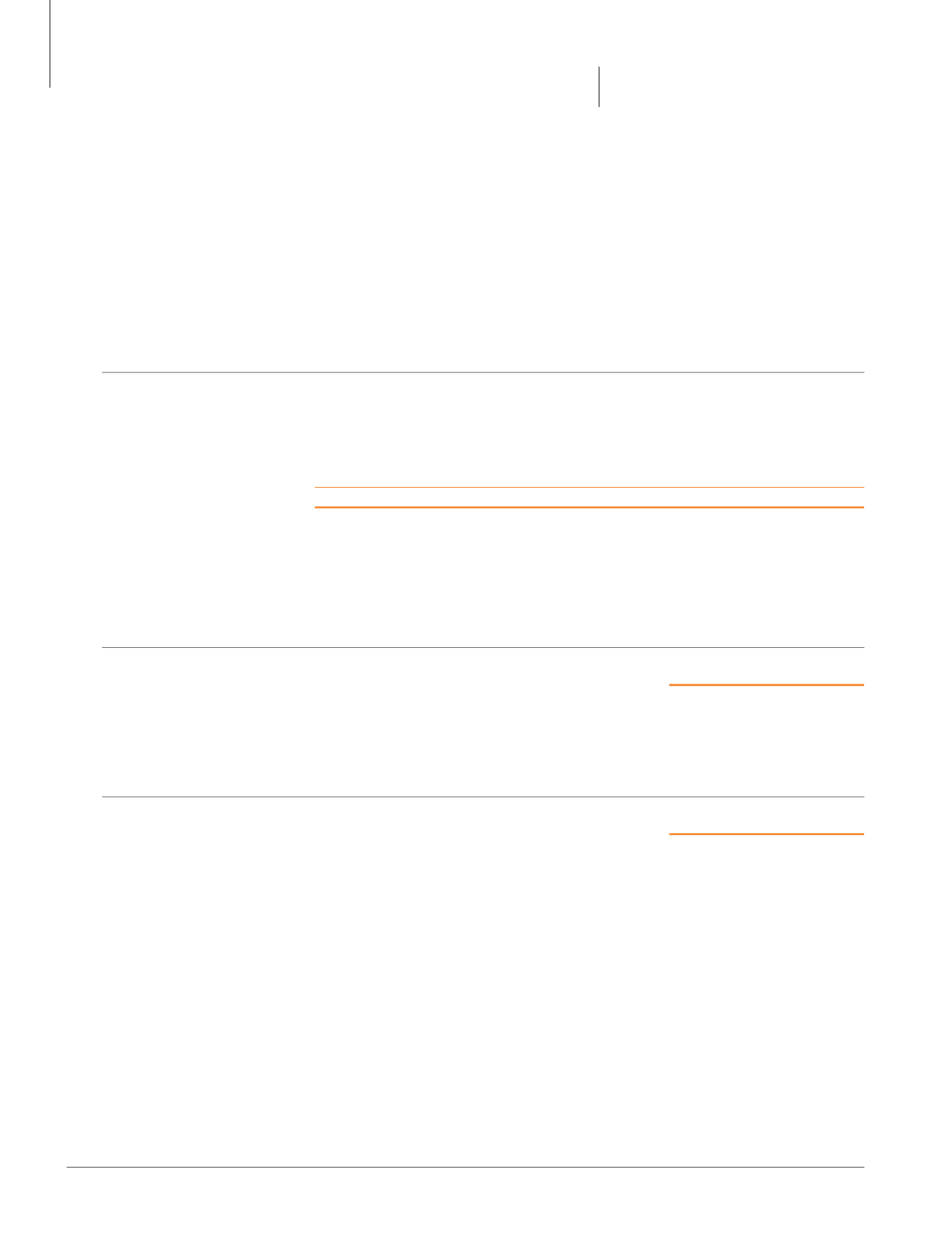

Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of the following item:

Group

31/12/2015

30/6/2014

$’000

$’000

Tax losses

20,889

–

The tax losses with expiry dates are as follows:

Group

31/12/2015

30/6/2014

$’000

$’000

Within 5 years

10,978

–

The remaining tax losses do not expire under current tax legislation. Deferred tax assets have not been recognised in

respect of this item because it is not probable that future taxable profit will be available against which the Group can utilise

the benefits therefrom.