224

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

NOTES TO THE FINANCIAL STATEMENTS

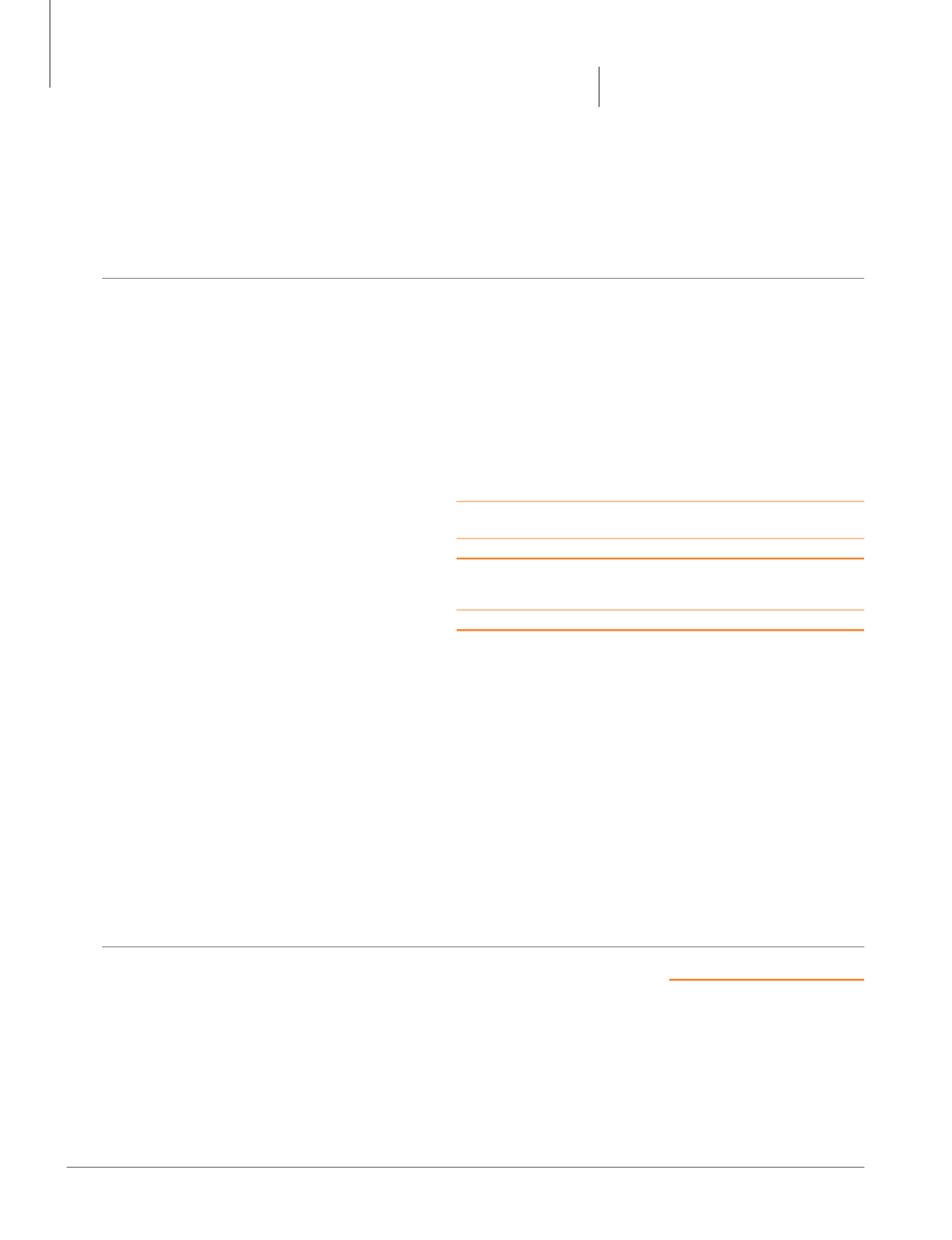

9 TRADE AND OTHER RECEIVABLES

Group

Company

31/12/2015

30/6/2014 31/12/2015

30/6/2014

$’000

$’000

$’000

$’000

Trade receivables

10,226

121

–

–

Deposit

5,833

1,405

–

–

Trade amounts due from:

– subsidiaries

–

–

2,964

–

– associates

386

2

–

–

Non-trade amounts due from:

– subsidiaries

–

–

46,029

–

– related corporations

2,247

36

–

1,303

– an associate

37,168

–

–

–

– joint ventures

2,103

464

–

–

– non-controlling interests

34,645

–

–

–

Other receivables

14,143

1,239

3,481

–

106,751

3,267

52,474

1,303

Prepayments

14,960

154

37

–

121,711

3,421

52,511

1,303

Non-current

15,401

1,840

–

–

Current

106,310

1,581

52,511

1,303

121,711

3,421

52,511

1,303

Non-trade amounts due from subsidiaries are unsecured, interest-free and repayable on demand.

Non-trade amounts due from an associate and joint ventures are unsecured and repayable on demand. In respect of

interest-bearing amounts owing by an associate with carrying amounts of $37.2 million (2014: Nil), interest is charged at

7.64% (2014: Nil) per annum.

Non-trade amounts due from related corporations and non-controlling interests are unsecured, interest-free and repayable

on demand.

The Group and the Company’s exposure to credit and currency risks, and impairment losses for trade and other

receivables are disclosed in note 26.

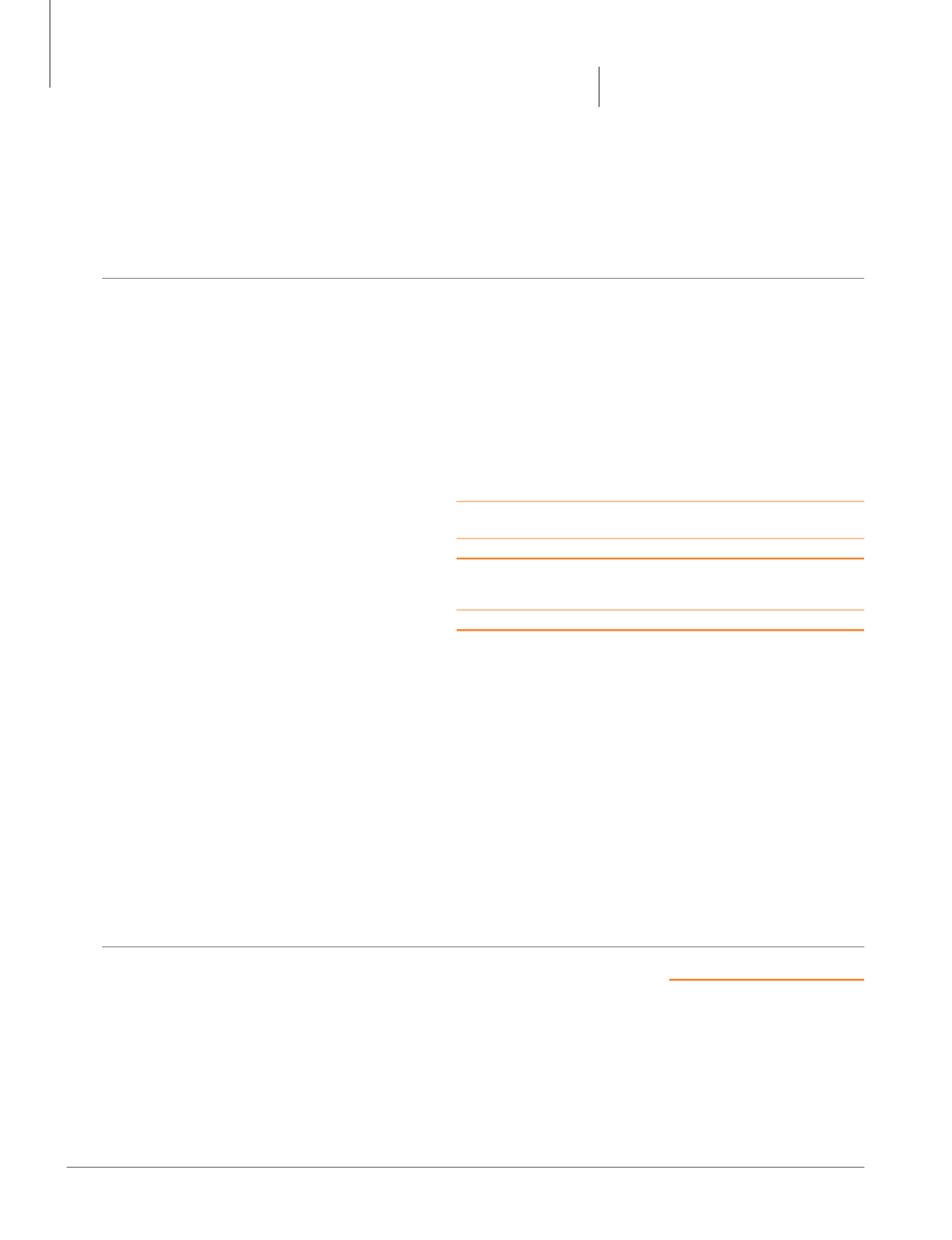

10 PROPERTIES UNDER DEVELOPMENT

Group

31/12/2015

30/6/2014

$’000

$’000

Properties in the course of development, at cost

1,756,442

–

The properties in the course of development are mainly land bank that the Group has intention to develop and sell

upon completion.

During the period, borrowing cost capitalised in properties under development amounted to $7.6 million. These borrowing

costs were incurred at interest rates ranging from 4.68% – 7.64% per annum.

The Group has acquired properties under development of approximately $1,722.2 million during the period (see note 4

part (A)(iii) and (B)(iii)).