240

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

NOTES TO THE FINANCIAL STATEMENTS

26 FINANCIAL INSTRUMENTS

(continued)

Credit risk

(continued)

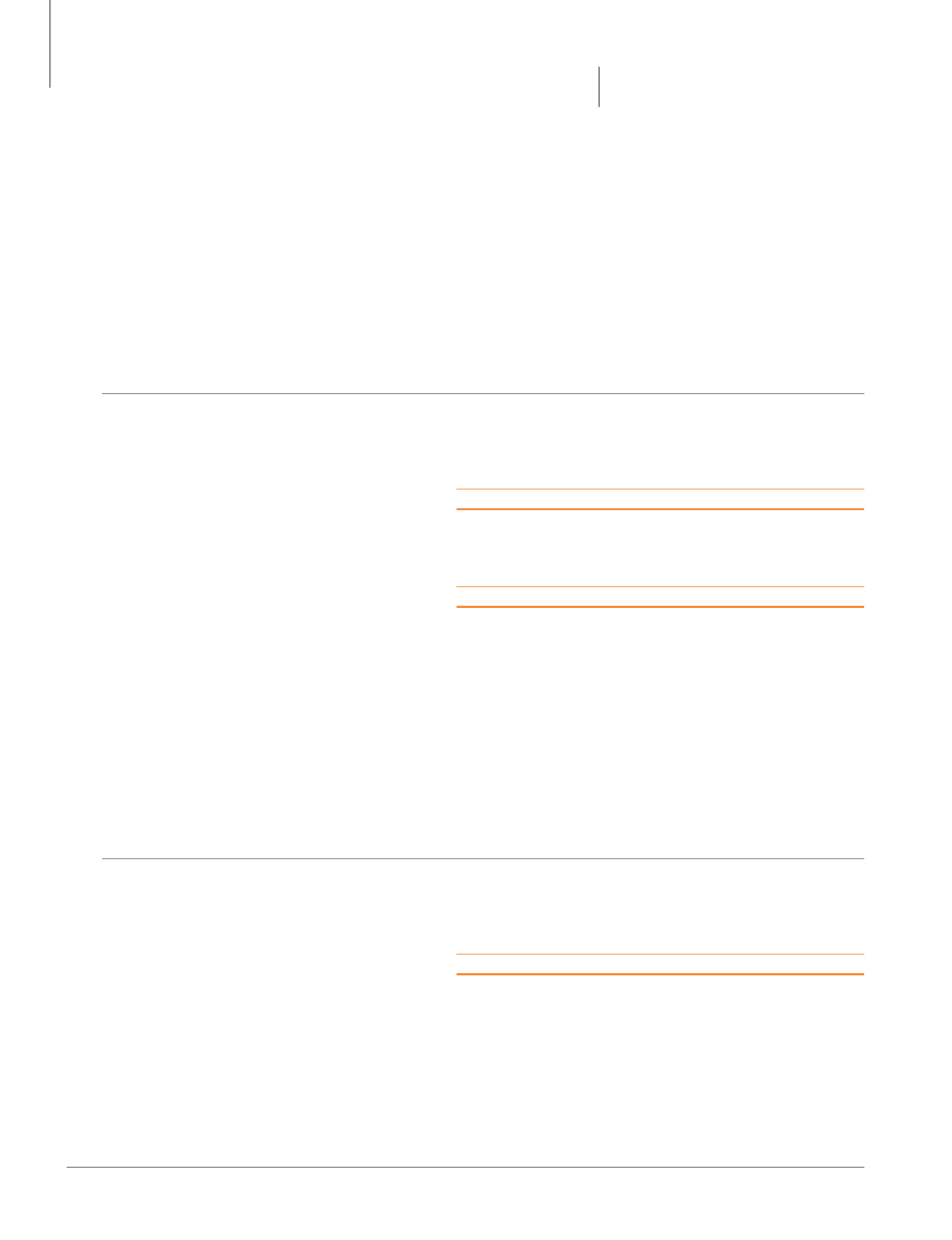

Exposure to credit risk

The maximum exposure to credit risk for trade and other receivables

(1)

at the reporting date by geographical region and

type of counterparty was:

Group

Company

31/12/2015

30/6/2014 31/12/2015

30/6/2014

$’000

$’000

$’000

$’000

By geographical areas

Singapore

50,525

3,267

52,474

1,303

PRC

51,218

–

–

–

Others

5,008

–

–

–

106,751

3,267

52,474

1,303

By type of counterparty

Related parties

76,549

502

48,993

1,303

Non-related parties

30,202

2,765

3,481

–

106,751

3,267

52,474

1,303

(1)

Excludes prepayments

As at 31 December 2015, the Group’s most significant counterparty, an associate of the Group, accounts for $37.2 million

of trade and other receivables carrying amount. Other than balances with related parties, there is no concentration of

customer risk at the Company level.

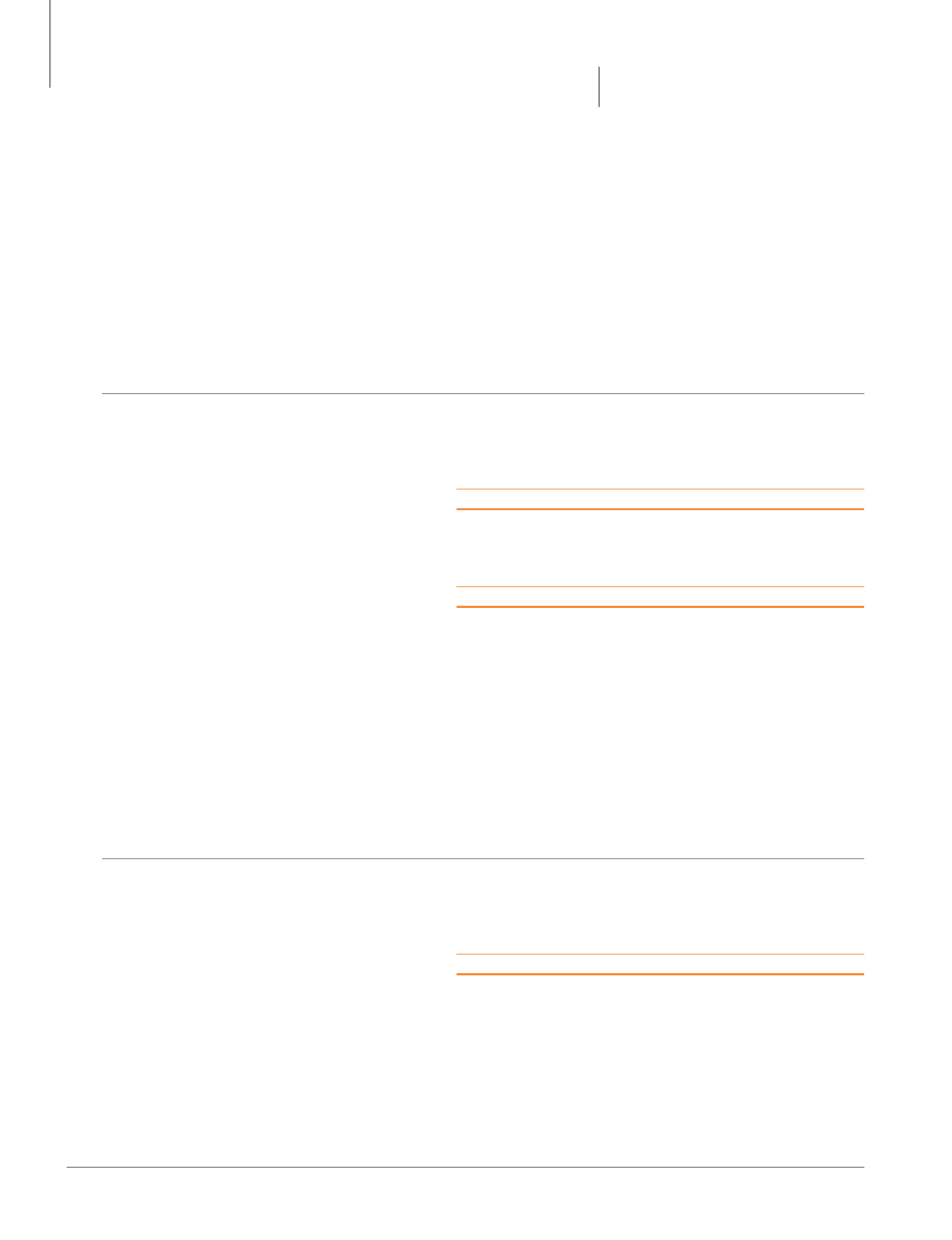

Impairment

The ageing of trade receivables that were not impaired at the reporting date was:

Group

Company

31/12/2015

30/6/2014 31/12/2015

30/6/2014

$’000

$’000

$’000

$’000

Neither past due nor impaired

9,200

123

2,964

–

Past due 1 – 30 days

350

–

–

–

Past due 31 – 60 days

410

–

–

–

Past due over 60 days

652

–

–

–

10,612

123

2,964

–

Trade and other receivables that are neither past due nor impaired are mainly related to companies with a good payment

track record with the Group.

The Group and the Company believe that the unimpaired amounts that are past due are still collectible based on historical

payment behaviour.