242

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

NOTES TO THE FINANCIAL STATEMENTS

26 FINANCIAL INSTRUMENTS

(continued)

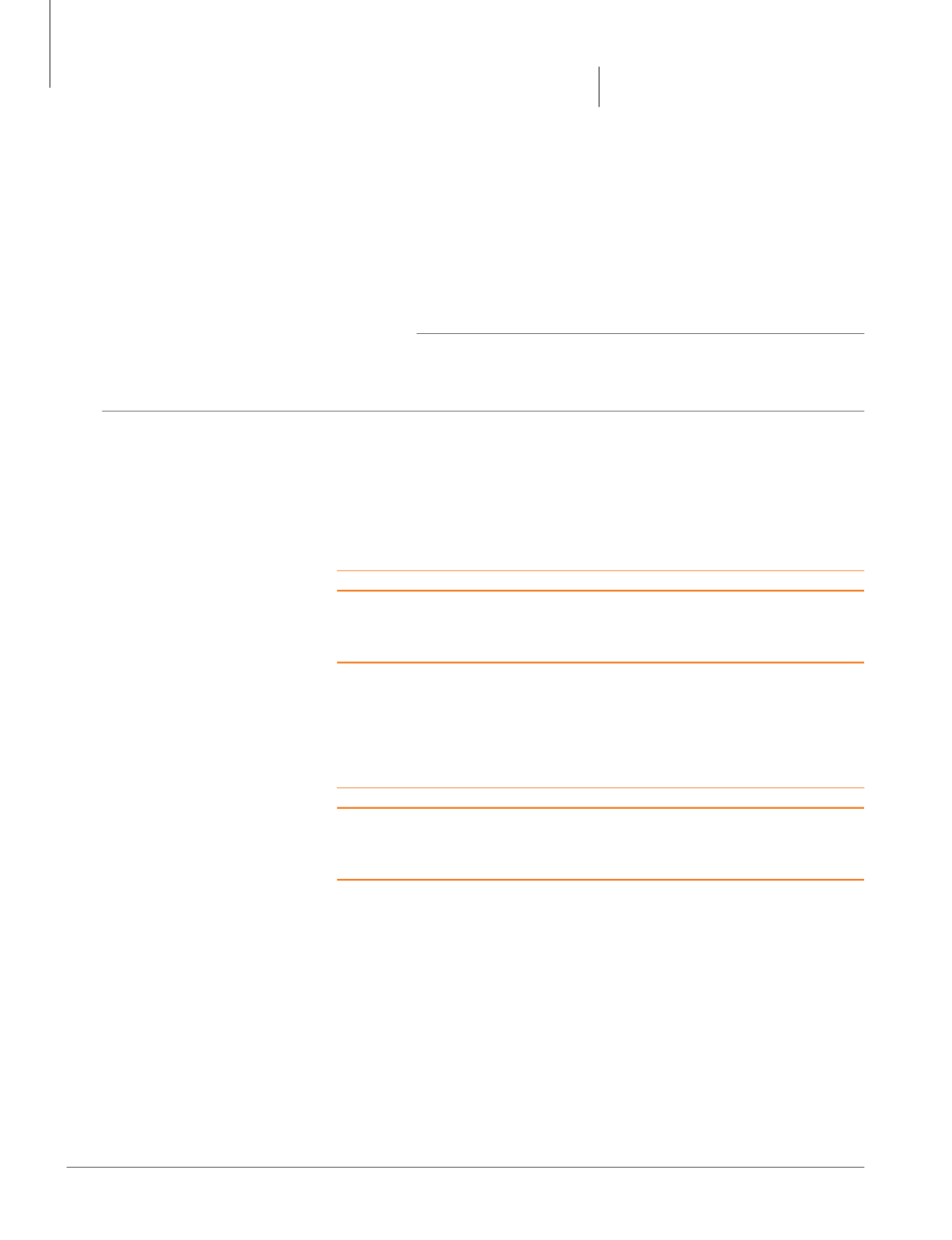

Liquidity risk

(continued)

Exposure to liquidity risk

The following are the contractual maturities of financial liabilities, including estimated interest payments:

Cash flows

No

Carrying Contractual

Within

2 to More than contractual

amount cash flows

1 year

5 years

5 years maturity

$’000

$’000

$’000

$’000

$’000

$’000

Group

31/12/2015

Non-derivative financial liabilities

Loans and borrowings

1,911,660 (2,088,237)

(238,212)

(1,841,864)

(8,161)

–

Trade and other payables

(1)

395,868 (398,415)

(363,041)

(35,374)

–

–

Junior bonds

143,924 (175,705)

(12,907)

(162,798)

–

–

Redeemable preference shares

47,613

(47,613)

–

–

–

(47,613)

2,499,065 (2,709,970)

(614,160)

(2,040,036)

(8,161)

(47,613)

30/6/2014

Non-derivative financial liabilities

Trade and other payables

7,277

(7,277)

(6,142)

(1,135)

–

–

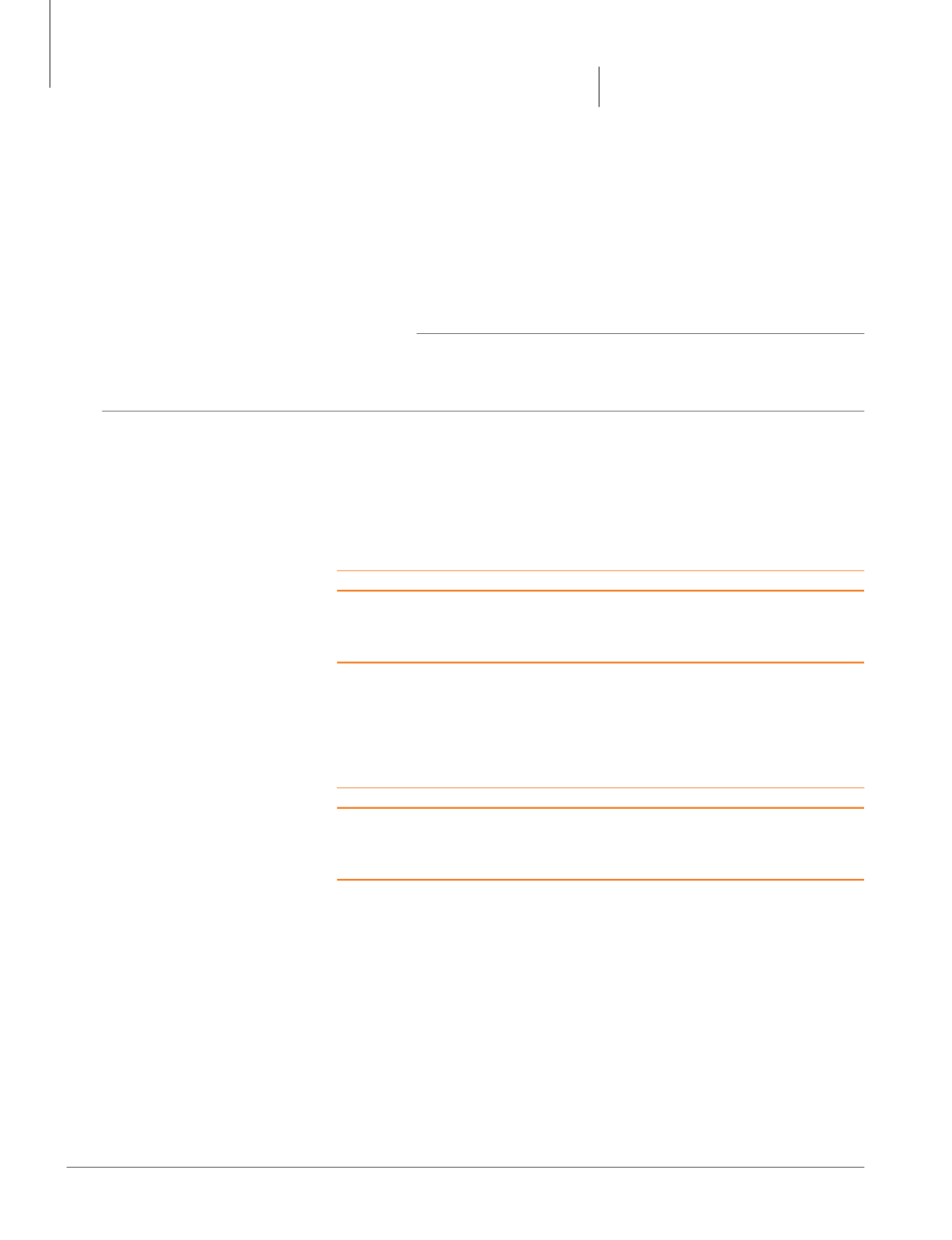

Company

31/12/2015

Non-derivative financial liabilities

Loans and borrowings

297,326 (339,334)

(13,950)

(325,384)

–

–

Trade and other payables

21,455

(21,455)

(21,455)

–

–

–

318,781 (360,789)

(35,405)

(325,384)

–

–

30/6/2014

Non-derivative financial liabilities

Trade and other payables

1,083

(1,083)

(1,083)

–

–

–

(1)

Excludes advanced rental received and deferred income

The maturity analyses show the undiscounted cash flows of the financial liabilities of the Group and the Company on the

basis of their earliest possible contractual maturity.

It is not expected that the cash flows included in the maturity analysis above could occur significantly earlier, or at significantly

different amounts.

In addition to the above table, the Company has exposure to liquidity risk from financial guarantees issued to certain

financial institutions, in respect of banking facilities and securities drawn by subsidiaries of $680.0 million (2014: Nil).

At reporting date, the Company does not consider that it is probable that a claim will be made against the Company under

the financial guarantee contracts. Accordingly, the Company does not expect any net cash outflows resulting from the

financial guarantee contracts.