114

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

FINANCIAL REVIEW

PERFORMANCE REVIEW

The performance for the 18-month financial period ended

31 December 2015 reflected mainly the operating results

of the real estate business of Perennial Real Estate

Holdings Limited (the “

Company

”) and its subsidiaries

(collectively, “

Perennial

”) as the Company was transformed

into an integrated real estate owner, developer and

manager following the successful completion of the

reverse takeover (“

RTO

”) of St. James Holdings Limited

(“

St. James

”) on 27 October 2014. The Company was

renamed as Perennial Real Estate Holdings Limited on

28 October 2014 to better reflect its business and

Perennial’s real estate business commenced immediately

thereafter. Perennial's financial year end was also

changed from 30 June to 31 December.

For the financial period from 1 July 2014 to 31 December

2015, the reported revenue was S$139.4 million while

the Earnings Before Interest and Tax (“

EBIT

”) and

Profit after Tax and Minority Interests (“

PATMI

”) were

S$196.9 million and S$79.0 million respectively. Prior to

the RTO, St. James was engaged in the entertainment

business and the Company ceased these operations on

27 October 2014 when the RTO was completed.

Excluding the operating results of St. James prior to

completion of the RTO, Perennial achieved a revenue

of S$132.6 million, an EBIT of S$197.1 million and a

PATMI of S$79.4 million for the financial period from

28 October 2014 (being the date of commencement of

the real estate business) to 31 December 2015 (“

Period

”).

REVENUE

Perennial’s real estate revenue of S$132.6 million was

derived mainly from two main business activities, namely

(i) the real estate development and investment and

(ii) the real estate management businesses. Management

businesses include asset and property management,

project and development management, project and design

management, as well as investment advisory services.

The revenue comprised mainly rental revenue generated

by CHIJMES and TripleOne Somerset in Singapore,

Perennial Jihua Mall and Perennial Qingyang Mall in

Foshan and Chengdu. Both Perennial Jihua Mall and

Perennial Qingyang Mall are held by Perennial China Retail

Trust (“

PCRT

”) which became a subsidiary of Perennial

following the successful completion of the conditional

Voluntary Offer (“

VO

”) in February 2015.

Perennial's real estate assets are located in Singapore,

China, Malaysia and Ghana. The operational assets are

in Singapore and China which are Perennial’s two core

markets. For the Period, Singapore assets contributed

approximately S$71.8 million of revenue, representing

54.1% of Perennial’s real estate revenue. The assets in

China (“

PRC

”) contributed revenue of S$31.2 million

(or 23.6% of Perennial’s real estate revenue), with the

remaining coming from the fee-based management

business which included a one-off acquisition fee of

S$11.7 million from the acquisition of AXA Tower in April

2015.

1 Perennial's real estate business commenced from 28 October 2014 as the RTO of St. James was completed on 27 October 2014.

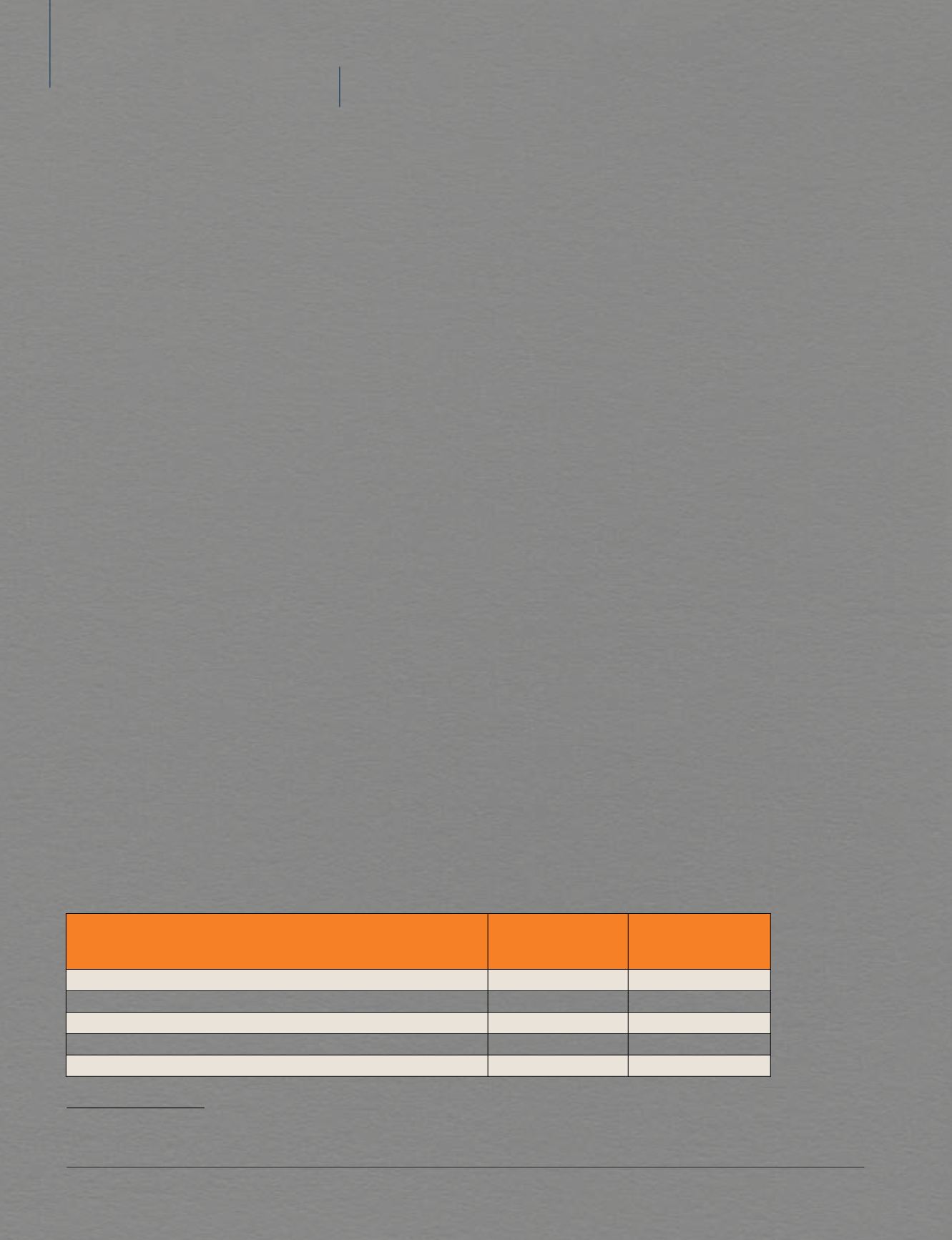

Revenue

28 October 2014 to

31 December 2015

S$M

Percentage

(%)

Singapore

71.8

54.1

China

31.2

23.6

Management Businesses

27.9

21.0

Corporate and Others

1.7

1.3

132.6

100

Revenue by Segment

From 28 October 2014

1

to 31 December 2015