116

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

FINANCIAL REVIEW

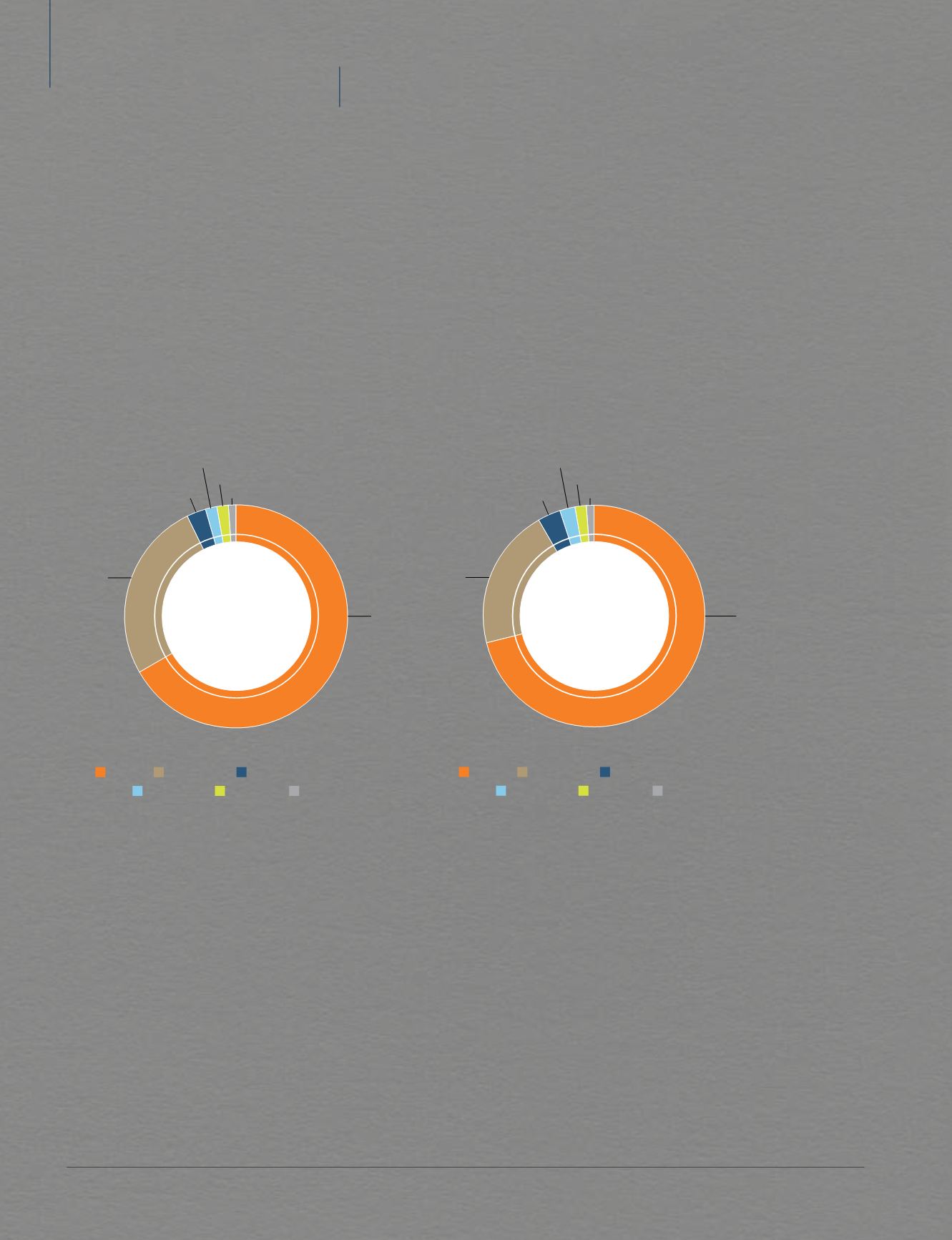

TOTAL ASSETS

Perennial’s total assets as at 31 December 2015 stood

at S$6.5 billion which comprised mainly real estate

assets which were acquired as part of the RTO and VO

exercises. On completion of the acquisitions made on

the RTO date, the total asset size was approximately

S$3.2 billion and this has since doubled with further

acquisitions under the VO which were completed in

February 2015 as well as the acquisition of the Beijing

Tongzhou Integrated Development Phases 1 and 2 in

April 2015.

The Singapore assets and China assets accounted

for approximately 26.7% and 68.1% of total assets

respectively.

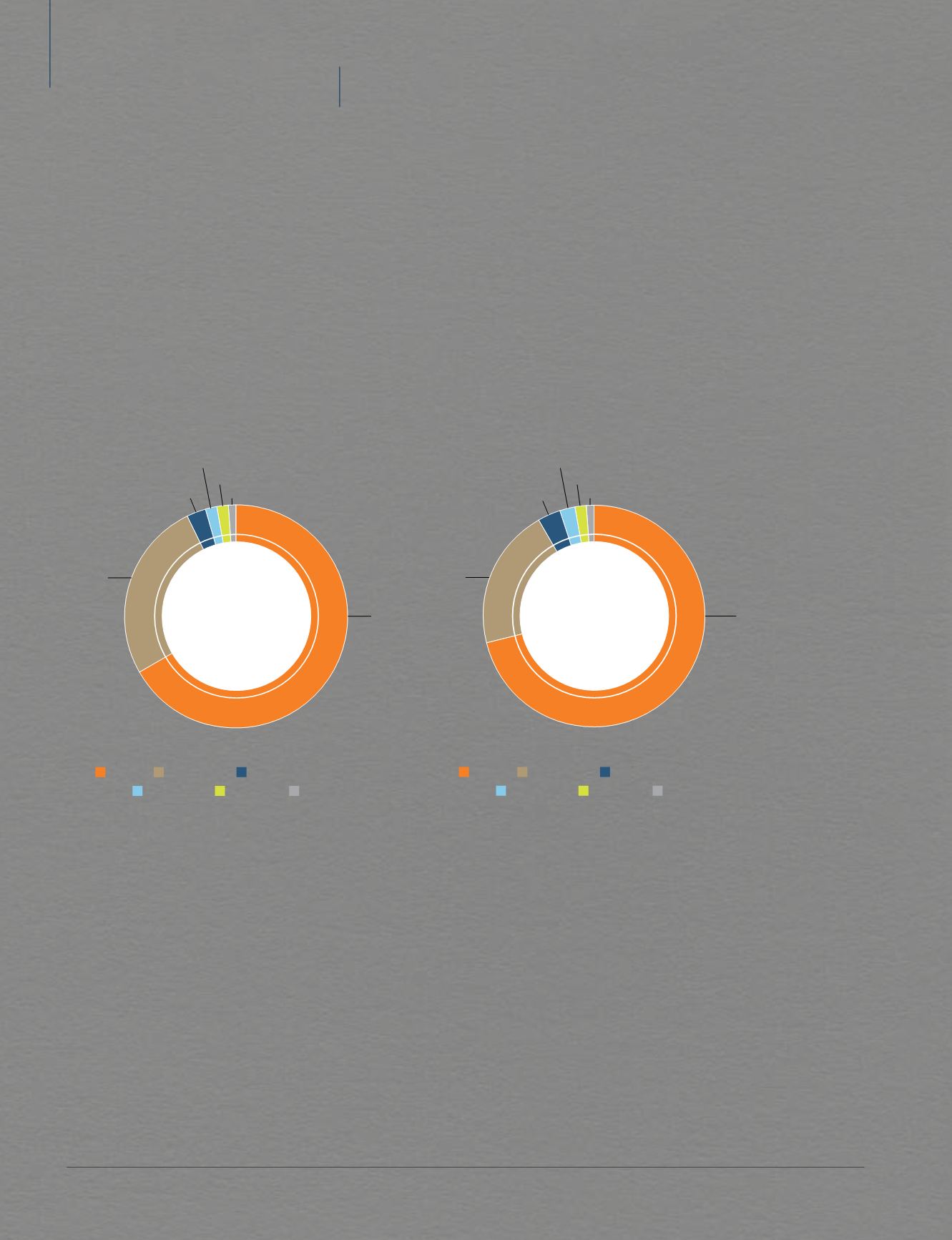

Perennial is strategically focused on the core markets of

Singapore and China. On an effective stake basis, each

of these two markets constituted about 21% and 72.6%

of total assets respectively.

As at 31 December 2015, Perennial’s investment

properties in Singapore included CHIJMES and TripleOne

Somerset and those in China included Perennial Jihua

Mall, Perennial Qingyang Mall and PIHMH.

Perennial’s investment in associates and joint ventures

included mainly Capitol Singapore, House of Tan Yeok

Nee and AXA Tower in Singapore, as well as Shenyang

Longemont Shopping Mall, Shenyang Red Star

Macalline Furniture Mall, Shenyang Longemont Offices,

Chengdu East High Speed Railway (“

HSR

”) Integrated

Development Plots C and D, Beijing Tongzhou Integrated

Development Phase 2 and Zhuhai Hengqin Integrated

Development in China.

Properties under development comprised mainly Xi’an

North HSR Integrated Development, Beijing Tongzhou

Integrated Development Phase 1 and Accra Integrated

Development, Ghana.

68.1%

26.7%

1.1%

1.3%

2.2% 0.6%

China

Singapore

Management Business

Corporate

Malaysia

Ghana

TOTAL

ASSETS

72.6%

21.0%

China

Singapore

Management Business

Corporate

Malaysia

Ghana

TOTAL ASSETS

(Effective Stake

Basis)

1.4%

1.7%

2.9% 0.4%