118

PERENNIAL REAL ESTATE HOLDINGS LIMITED

Annual Report 2015

FINANCIAL REVIEW

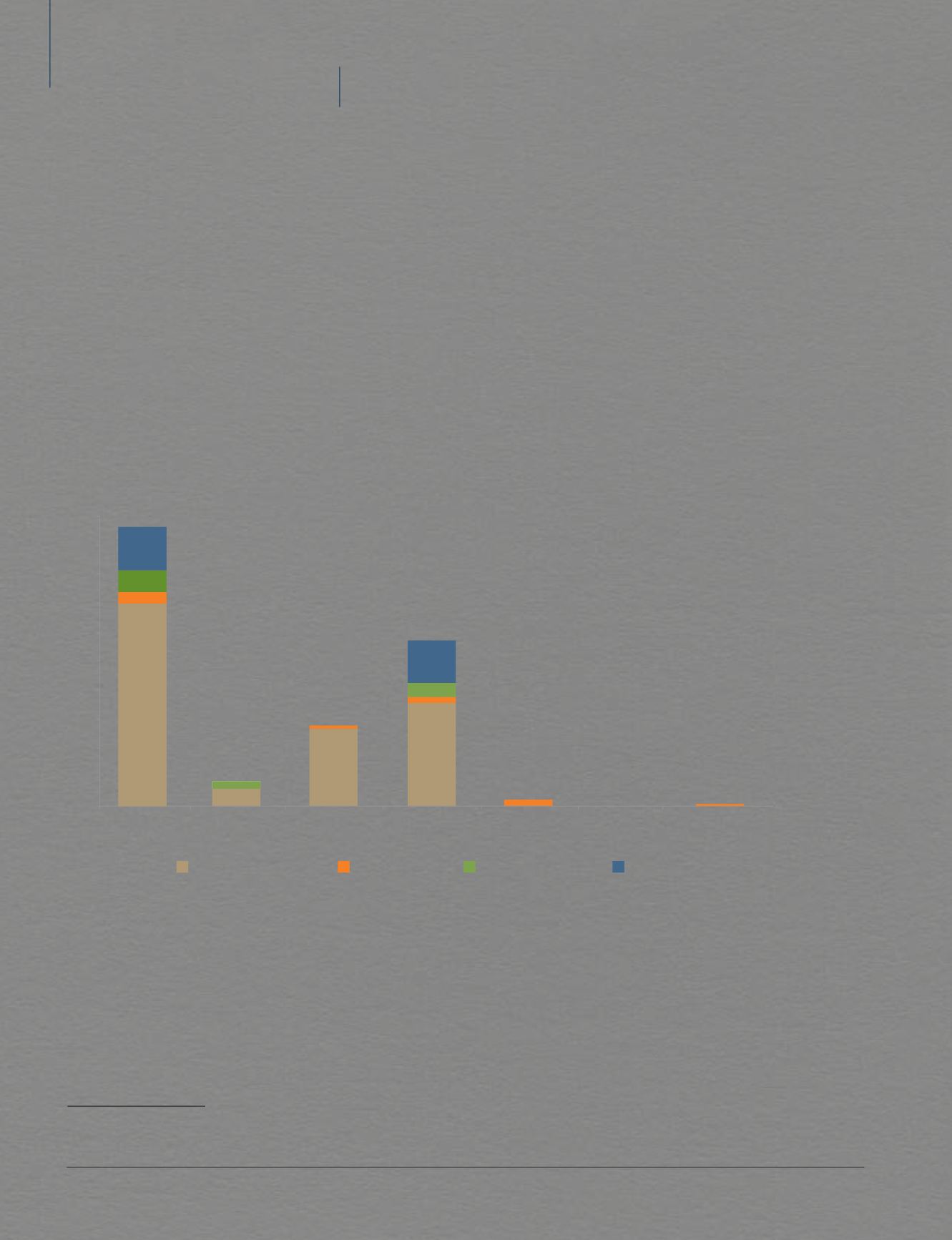

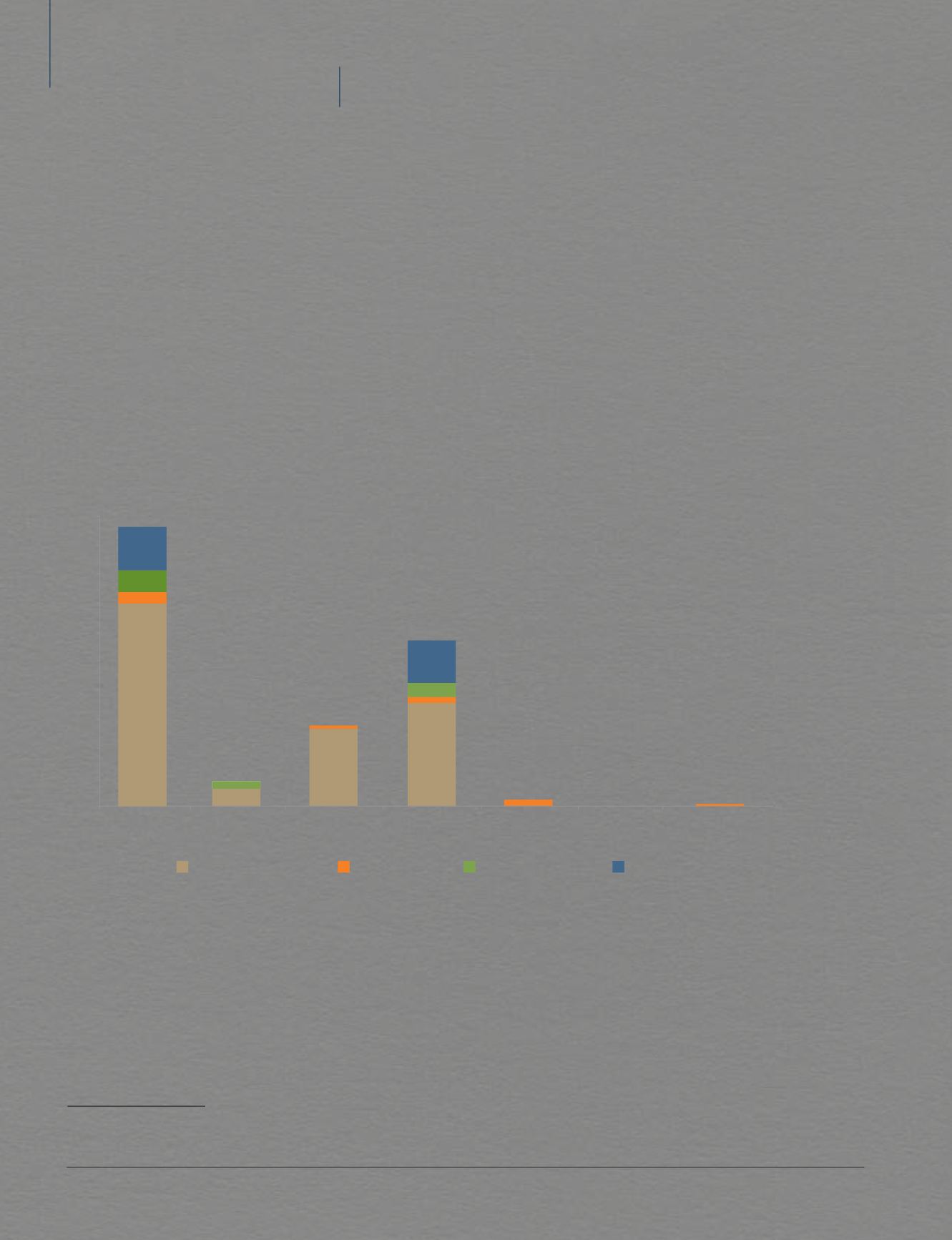

DEBT PROFILE

Perennial regularly reviews its debt maturity profile as

part of its disciplined financial management. The tenure

of new loans or refinancing would be spread out where

possible, to mitigate concentration and refinancing risks.

Perennial also strives to strike a balance between managing

its average interest cost and extending its debt maturity

profile. For the Period, Perennial’s weighted average

interest rate of its total borrowings was 3.4% per annum.

As at end 2015, Perennial has a weighted average debt

maturity profile of 2.1 years.

As at 31 December 2015, Perennial's borrowings

comprised 95.9% denominated in Singapore dollar and

4.1% denominated in Renminbi. Where practicable,

Perennial will borrow in the same functional currencies

of its overseas projects to achieve a natural foreign

exchange hedge.

1 Being the gross amount, without amortised transaction costs.

Debt Maturity Profile

S$M

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Total

2016

2018

2017

2019

22

2020

2021

4

1,172

558

170

1,926

Singapore Loans

1

China Loans

1

Fixed Rate Notes

1

Retail Bonds

1

CASH FLOWS

As at 31 December 2015, Perennial has a cash

balance of S$162 million. For the Period, net cash of

S$88.2 million was used in operating activities, mainly

towards properties under development as well as

settlement of trade payables.

Net cash used in investing activities of S$228.8 million

was mainly for acquisition of associates and capital

expenditure incurred in investment properties. Net cash

from financing activities of S$475.7 million mainly arose

from net proceeds from borrowings, issuance of Fixed

Rate Notes and Retail Bonds.